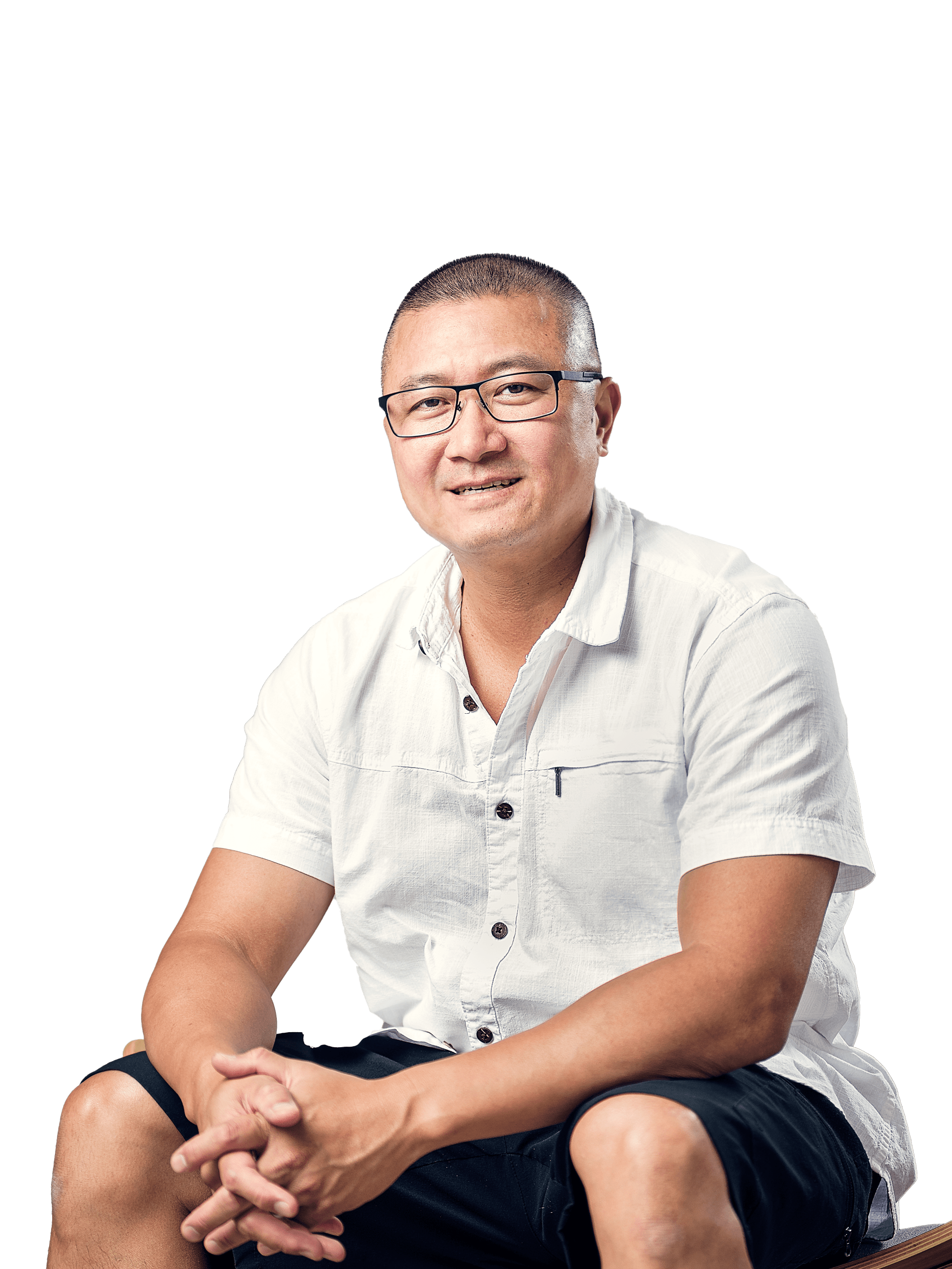

Kasey Wong, a co-founder and Managing Member of Cacoeli, is responsible for overseeing the company’s acquisition analysis, business development activities, and asset management. He also jointly directs the overall investment strategy, bringing over 22 years of leadership and management experience.

Since 2003, he has overseen more than 3,000 units, ranging from apartment rental buildings and upscale high-rise condominiums to townhomes and retail condominium plazas. With a wealth of property management expertise, Kasey has managed rental properties and condominium buildings typically consisting of 100-300 suites.

Before co-founding Cacoeli, Kasey was an asset manager for organizations such as Brookfield Residential Services and CAPREIT.

Throughout his career, Kasey has been dedicated to transforming underperforming assets into high-performing ones. He has gained extensive knowledge and expertise in various aspects of property management, including building structure, elevator modernization, energy retrofit, solar panels, and more, by working with both owner-occupied high-end residential units and tenant-occupied mid-market apartment buildings.

Away from his professional responsibilities, Kasey is an avid Toronto Raptors fan, enjoys playing ultimate frisbee and softball, and loves exploring the local restaurant scene.

Company Address:

Suite 2000 - 2 Sheppard Ave East

Toronto, ON

M2N 5Y7

Contact Cacoeli

– Your net income before taxes exceeded $200,000 in both of the last two years and you expect to maintain at least the same level of income this year; OR

– Your net income before taxes, combined with that of a spouse, exceeded $300,000 in both of the last two years and you expect to maintain at least the same level income this year;

– You alone or together with a spouse, own financial assets worth more than $1 million before taxes but net of related liabilities. Cash, or certain investments such as public equity or bonds, would be considered liquid/financial assets.

– You, who alone or together with a spouse, have net assets of at least $5,000,000; This criteria requires that an individual have net assets that count for at least $5 million, with liabilities subtracted. This means that an investor with $4.5 million in real estate and $500,000 in cash may be considered an accredited investor.

– You currently are, or once was, a registered advisor or dealer, other than a limited market dealer.

© Cacoeli 2023. All rights reserved.